The consequences of the cash crisis caused by the monetary policies of the Cuban regime continue to manifest themselves in the form of long lines of users in front of banks and ATMs to withdraw money from their accounts.

The situation has become even more dramatic these days when many Cubans are preparing to celebrate the Mother's day (Sunday, May 12), a celebration in which Cuban mothers and grandmothers are traditionally entertained.

“The situation is very serious right now outside the Cruces municipal bank, while dozens of people wait to collect salaries and retirement on the eve of Mother's Day. BANDEC is cashless!” he reported. Yamil Cuellar in the group of Facebook 'Mills'.

The Banco de Crédito y Comercio (BANDEC) of Cruces, Cienfuegos, is no exception. Broken ATMs, long lines and low availability of cash, is the panorama that people who have been trying to extract their salaries and pensions throughout Cuba have been experiencing for months.

The failureeconomic and monetary order”implemented by the deposed Minister of Economy and Planning, Alejandro Gil Fernandez, ended up delivering the fatal blow to the national currency, skyrocketing its price in the informal market due to the unavailability of dollars in the Exchange Houses (CADECAS), and precipitating uncontrolled inflation in the economy.

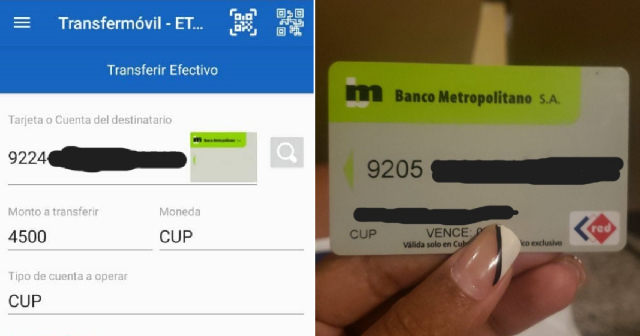

“Since the 5th, many people have been waiting for the money transfer to come in, which was finally deposited on the 8th into the electronic cards. However, for many it has been of no use, since the bank has run out of money,” Cuéllar denounced in his publication.

The activist, also an administrator of the aforementioned group, indicated that some neighbors were lucky enough to be able to extract part of the money from their salaries and pensions, “insufficient to cover the expenses that have accumulated and the enormous need to buy food in the coming years.” days".

“Possibly until the end of this month, clients will not see the rest of the money in their hands again… if it does not run out before, or they resort to new arrears. "What are the people going to eat whose money is kidnapped by the incompetence of a system in total collapse?" the activist asked, criticizing a situation that adds to the generalized debacle of the economy, the increase in blackouts and the inability of the “continuity” government of Miguel Díaz-Canel to remedy this loss in the purchasing power of Cubans.

What do experts and users say?

According to the economist Pavel Vidal, a scholar at the Javeriana University of Colombia, the Cuban crisis has triggered the informal economy and especially the informal exchange market “of which an important part works in cash, then you have a government issuing a lot of money without the capacity, without the dollars, to be able to print the pesos”.

The professor blamed the government because “Nor has it wanted to print larger denomination bills"The highest denomination bill is one thousand pesos, which in the informal market exchange rate is three dollars."

“The latest data that appears in the statistical yearbook, 70 percent of that money is in cash and only 30 is in the banks"said Vidal, pointing out the ineffective banking process that the regime forcibly promoted, as a palliative to the strong liquidity crisis.

The cash shortage is so severe that drastic measures are applied in some Cuban territories. In the province of Sancti Spíritus, BANDEC made the decision to not restocking ATMs at your main branch.

Luis Francisco Castro Diaz, BANDEC Business Manager in the territory, confirmed to Escambray that the measure could be extended to other municipalities in the coming weeks.

According to the media, citizens who need cash are forced to stand in long lines to be served by the cashier service inside the branch itself and will be able to withdraw up to 5 thousand pesos.

In recent days, the Central Bank of Cuba (BCC) reiterated to Cubans that, given the recurring shortage of cash in ATMs, they should go to warehouses or other commercial establishments of the Ministry of Internal Trade (MINCIN). in order to extract cash from their bank accounts through the "Caja Extra" service.

Although the system It was approved since September 2021 Apparently it has not had the expected follow-up, so the BCC reiterates to its clients how to do it.

“It took me three days to withdraw money from an ATM, today I came here and took it out,” denounced a man in Havana, seeing his life turned upside down because it is becoming increasingly difficult for him to access cash.

Another person described the chaotic situation in the capital: “There is no money, the ATMs are broken, when they put money they put little.”

"Although many have woken up early, they fear that they will not be able to get some cash and They are going to have to resort to the 'changers' who are charging between 10 and 20% interest", the independent journalist recently explained on Facebook Yosmany Mayeta Labrada, referring to the huge lines that bank clients have to stand in to withdraw cash from ATMs in Santiago de Cuba.

What do you think?

COMMENTFiled in: