Related videos:

A group of eight Italian businessmen is being investigated for their involvement in a complex tax fraud scheme valued at nine million euros, linked to commercial transactions with clients in Cuba, as revealed by the newspaper Corriere Torino.

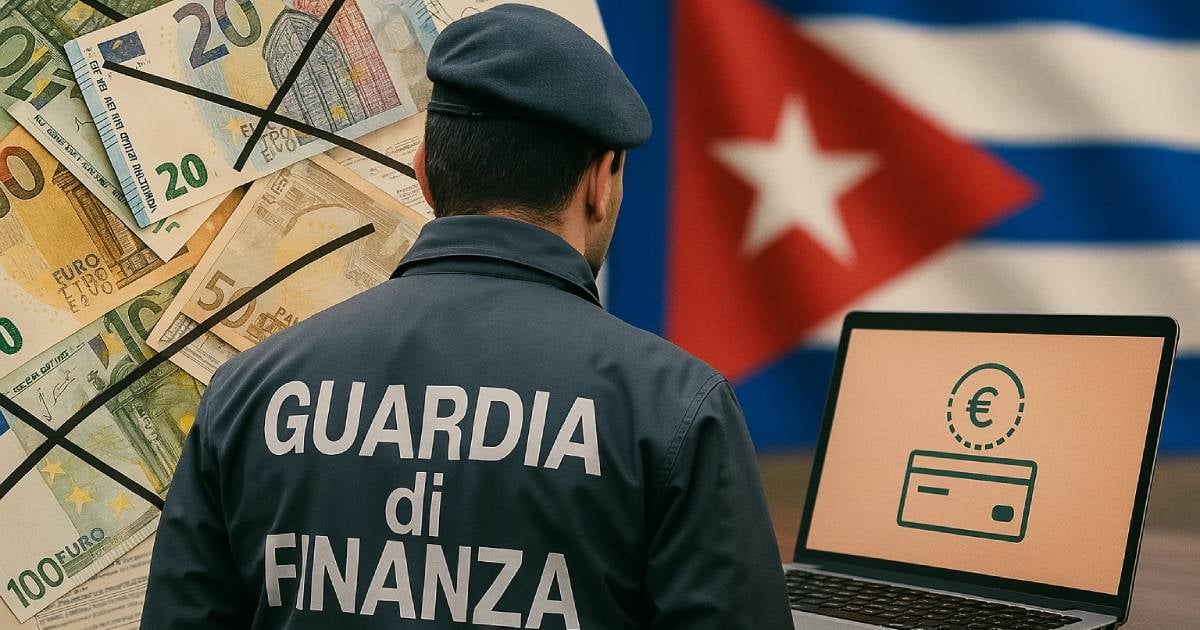

The operation, named "Cuba Libre" and carried out by the Guardia di Finanza of Turin, uncovered a network of seven companies, including entities registered in England and Panama, that were used to simulate international operations and hide millions in income generated in Italy.

Investigations began following tax audits of two Turin businessmen, who were operating through fictitious companies registered under English law dedicated to issuing invoices for non-existent commercial transactions. The goal was to evade taxes in Italy by manipulating the prices of technological products supposedly exported to Cuba.

The mechanism involved selling computer products from a company based in Turin to Cuban clients, using shell companies in England and Panama as intermediaries.

The invoices stated a price lower than the actual one, while the rest of the payment was deposited "under the table" into the private accounts of the Italian entrepreneurs.

In reality, the goods never passed through these countries, but would be sent directly from Turin to Havana, generating an illegal profit of approximately six million euros.

During the investigation, authorities identified a “treasure” of 1.5 million euros deposited abroad and conducted raids, on-site inspections, and analyses of computers and suspicious transactions, which allowed them to reconstruct the fraudulent scheme.

The two main suspects, both residents of Turin, have already paid 1.7 million euros to the Italian tax authorities to partially regularize their situation.

Moreover, the investigation uncovered a case of extortion, in which a man who had lent a large sum of money to the involved executives subsequently threatened to report the fraud to the Prosecutor's Office if they did not meet his financial demands.

This case adds to another recent one in which the Caribbean island appears as a destination or indirect actor in fraud schemes.

In March of last year, a businessman from Hialeah, Florida, attempted to flee to Cuba after being accused of defrauding Medicaid of more than 41 million dollars.

The man was arrested when he was trying to board a flight to Varadero, in an attempt to evade U.S. justice.

Frequently Asked Questions about Tax Fraud and Business Operations with Cuba

What are the Italian entrepreneurs accused of in relation to Cuba?

Eight Italian businessmen are accused of participating in a tax fraud scheme related to fictitious business transactions with Cuba, aimed at evading taxes in Italy by manipulating the prices of technological products.

How did the tax fraud scheme linked to Cuba operate?

The scheme involved the sale of computer products from Turin to Cuba, using shell companies in England and Panama to simulate operations. The invoices reflected prices lower than the actual ones to evade taxes, while the remaining payment was diverted to the private accounts of the entrepreneurs.

What actions did the Italian authorities take in this case?

The Guardia di Finanza of Turin conducted Operation "Cuba Libre," uncovering the fraud network. The authorities carried out raids and inspections that allowed them to reconstruct the fraudulent scheme and secured a portion of the illegal funds abroad.

What other recent cases of fraud are related to Cuba?

In addition to the case of the Italian businessmen, a businessman from Hialeah, Florida, attempted to flee to Cuba after being accused of defrauding Medicaid of over 41 million dollars, highlighting a pattern of fraud directly or indirectly related to the island.

Filed under: