One of the most controversial measures of the new fiscal plan proposed by the Trump Administration is the imposition of a special 5% tax on remittances sent from the United States abroad.

The legislative proposal, known as "The Only, Great, and Beautiful Bill," was introduced by the Republicans in the United States House of Representatives and has sparked a wave of criticism both nationally and internationally.

This initiative would affect more than 40 million people, including legal permanent residents and holders of work visas such as H-1B, H-2A, and H-2B, according to the agency AP.

The measure would obviously also affect immigrants of Cuban origin. Only U.S. citizens and nationals would be exempt.

“The provision imposes a special tax of 5% on remittance transfers, which will be paid by the sender”, states the text of the legislative proposal.

The plan is part of a broader set of restrictive measures related to immigration and taxation, which also includes a presidential memorandum -still in the works- aimed at "ending the remittances" sent by individuals in irregular immigration status.

How would the measure work?

The proposal includes an exception for shipments made by U.S. citizens through qualified providers, who must sign agreements with the Department of the Treasury to verify the identity of the senders.

Those who cannot prove their citizenship or nationality, such as undocumented immigrants who use an Individual Taxpayer Identification Number (ITIN) instead of a Social Security Number (SSN), would not be able to deduct the tax or recover the money.

A new front in the offensive against migrants

In addition to the remittance tax, the tax reform includes the elimination of the child tax credit for families with mixed immigration status, which would affect more than 4.5 million U.S. citizen children.

It also limits tax benefits associated with the health system (Obamacare), deductions for tips, overtime, and access to Medicare for those without an SSN.

“They are seeking to ensure that undocumented individuals have no escape”, warned José Iván Rodríguez-Sánchez, a researcher at the Center for the United States and Mexico at Rice University.

"One way to do it is through money, making less of it reach their homes," she added.

A vital cash flow: 656 billion in 2023

The World Bank estimated that in 2023, $656 billion in remittances were sent to countries of origin, equivalent to Belgium's GDP.

Mexico was one of the main recipients, with a record of 63.3 billion dollars sent that year.

For countries like Guatemala, El Salvador, and Nicaragua, remittances accounted for between 19% and 27% of their Gross Domestic Product (GDP), according to a report by BBVA.

Experts warn about counterproductive effects

From the academic community and analysis centers, the proposal raises significant concerns. Manuel Orozco, director of the Migration, Remittances, and Development Program at the Inter-American Dialogue, believes that the measure would have the opposite effect of what the government intends.

"Any measure to reduce remittances will have a negative impact on the national interest of the United States," he stated.

"Sending less would have an impact on recipient households, limiting their ability to save, and in turn, could increase the intention to emigrate," he added.

A symbolic tax or a political weapon?

From a fiscal perspective, the economic yield of the tax would be limited. According to the Joint Tax Committee cited by the Institute of Fiscal and Economic Policies (ITEP), the new levy would only generate about 22 billion dollars over ten years.

Jon Whiten, deputy director of ITEP, insists that the goal is more political than revenue-generating.

"This is not the only tax reform that will affect immigrants. It is just part of a larger assault, which is a central theme of the tax bill," he pointed out.

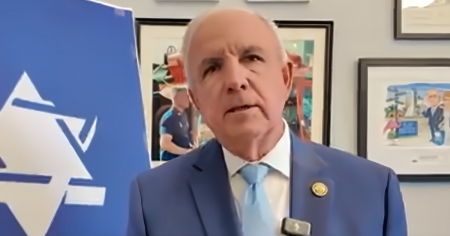

The initiative, spearheaded by Congressman Jason Smith, is part of a broader legislative package aimed at fulfilling several of President Donald Trump's promises.

Some experts indicate that most remittances are sent by workers who are already paying taxes in the United States.

A study by Americans for Tax Fairness indicates that immigrants, including undocumented individuals, contribute over 650 billion dollars in taxes annually, and that imposing this tax on remittances could be seen as double taxation.

The risk of parallel and unsafe routes

By reducing access to formal shipping methods, experts fear the proliferation of informal and less secure channels, which could foster the emergence of criminal networks.

"It can undermine the quality, safety, and transparency of operations," warns Rodríguez-Sánchez.

The House of Representatives is scheduled to hold a vote on the bill around the Memorial Day weekend (May 26).

However, strong opposition is expected from the Democrats and some Republicans concerned about the economic and social implications of the measure.

It will then need to be approved by the Senate -also with a Republican majority- before reaching President Trump's desk for signature, scheduled for July 4th, in a symbolic gesture of power and economic nationalism.

Filed under: