The U.S. dollar rose again this Saturday in the informal Cuban market, consolidating its upward trend and confirming the recovery of value for major foreign currencies against the Cuban peso.

According to the Representative Rate of the Informal Market (TRMi) published by elTOQUE, the dollar (USD) is valued this Saturday, November 15, at 470 Cuban pesos (CUP), five pesos more than the previous day.

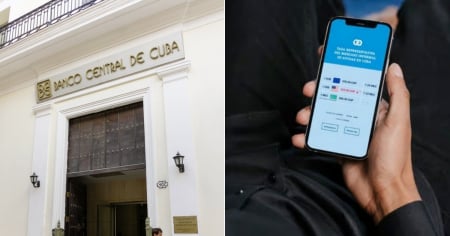

Informal exchange rate in Cuba Saturday, November 15, 2025 - 04:04

- Exchange rate of the dollar (USD) to Cuban pesos CUP: 470 CUP

- Exchange rate of the euro (EUR) to Cuban pesos CUP: 500 CUP

- Exchange rate from (MLC) to Cuban pesos CUP: 210 CUP

The euro (EUR) remains at 500 CUP, while the Convertible Currency (MLC) maintains its stability at 210 CUP.

Exchange Rate Evolution

A week of uninterrupted increases

With this Saturday's increase, the dollar has recorded seven consecutive days of gains, after having fallen at the beginning of the month to 410 CUP, its lowest level since August.

In just a week, the US dollar has recovered 60 pesos, bringing it within 20 Cuban pesos of its highest level on record (490 CUP at the end of October), reflecting a corrective movement and increasing pressure on the exchange market.

The euro, for its part, is stabilizing at the threshold of 500 CUP, after experiencing a significant surge in recent days. The European currency dropped to 450 during the recent downturn, having reached 540 at the end of October, a historic high that it is aiming for once again.

Together, both currencies confirm the consolidation of the upward trend that began on November 9, marking the end of the downward streak that dominated the second half of October.

Inflation and distrust drive demand

The sustained rise of foreign currencies is due to unresolved structural factors: persistent inflation, cash shortages, banking restrictions, and a profound mistrust in the Cuban peso and the regime's economic institutions.

The lack of official transparency and the silence of the Cuban regime regarding the promised "floating rate" exacerbate uncertainty, while the informal market continues to serve as the real benchmark for the value of the national currency.

Filed under: