Related videos:

The Cuban regime announced on Monday that foreign companies will be able to operate directly in foreign currency within the island, as part of a new scheme for partial dollarization of the national economy.

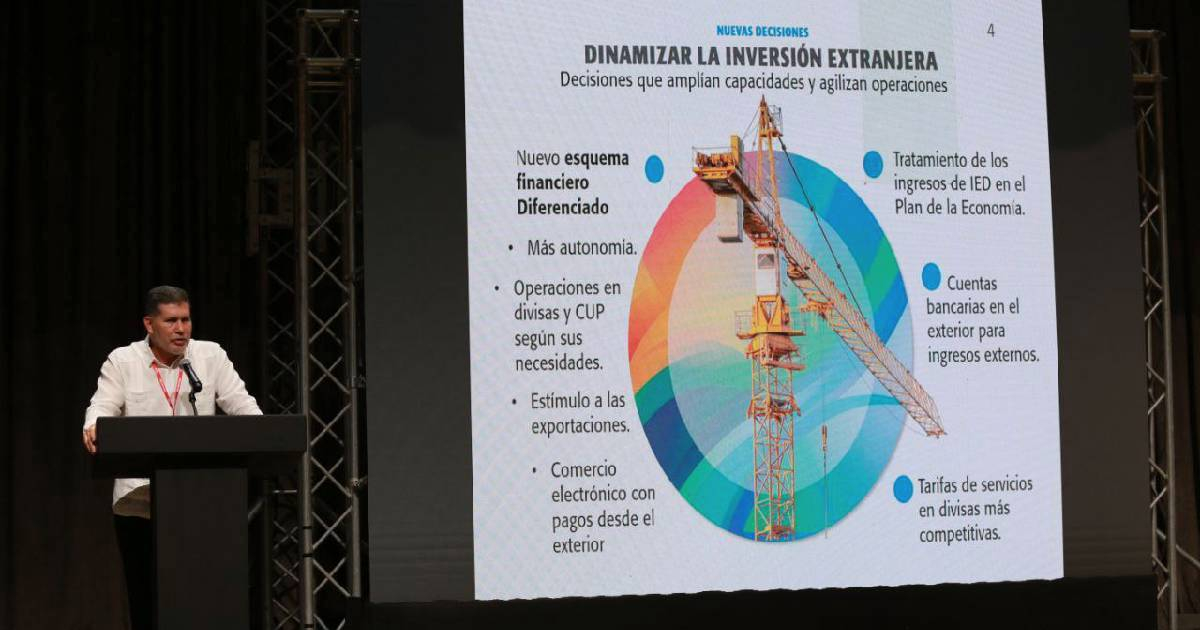

The measure, amidst a serious economic crisis marked by the devaluation of the Cuban peso, was presented by the Vice Prime Minister and Minister of Foreign Trade and Foreign Investment (MINCEX), Oscar Pérez-Oliva Fraga, during the opening of the VIII Investment Forum at the International Fair of Havana (FIHAV 2025).

According to the official, the change is part of “a package of transformations” aimed at attracting foreign investment and easing foreign investment operations in Cuba, a sector that currently includes more than 370 businesses from 40 countries, as reported by the official site Cubadebate.

"A new differentiated operating scheme will be established for foreign investment, which will be able to operate, according to its needs, in the national currency and in foreign currencies," stated Pérez-Oliva Fraga.

The new model aims to allow foreign companies to obtain and manage foreign currency earnings independently, either through exports or via segments of the domestic market that generate hard currency.

The measure, which deepens the process of dollarization of the economy, responds to the structural crisis of the Cuban peso (CUP) and the increasing need of the regime to attract fresh foreign currency due to the lack of liquidity.

The head of MINCEX also stated that companies will be able to open bank accounts abroad, an option already provided for in Cuban legislation, but now politically supported as a tool to facilitate international transactions and counter the effects of the U.S. embargo.

"These transformations are tied to the process of partial dollarization of the economy and aim for foreign investment to focus on generating external income," emphasized Pérez-Oliva.

The deputy prime minister also announced that exchange rate tariffs will be established for certain goods and services, with the aim of making them “more competitive and more aligned with the reality of the currency market.”

The MINCEX expects to issue a new decree that will replace the current Decree 325 (regulations of Law 118 on foreign investment), and to update Resolution 21, in order to simplify procedures and reduce the approval timelines for projects.

Pérez-Oliva stated that the goal is to "create a more transparent and efficient environment for investors," although he did not provide details on the guarantees for capital repatriation, which remains one of the main concerns for foreign businesses.

Economists consulted by independent media indicate that this type of measure confirms that the Cuban government is moving towards selective dollarization, in which only certain actors can operate in foreign currency, while the majority of citizens receive salaries in a currency with no real value.

The decision also reflects the failure of the Cuban peso and the monetary unification implemented in 2021, which led to inflation, shortages, and a loss of purchasing power.

Although the government tries to justify the opening as an “updating of the socialist model,” the truth is that it is a desperate strategy to attract dollars amidst a stifled economy with no investor confidence.

Filed under: