Related videos:

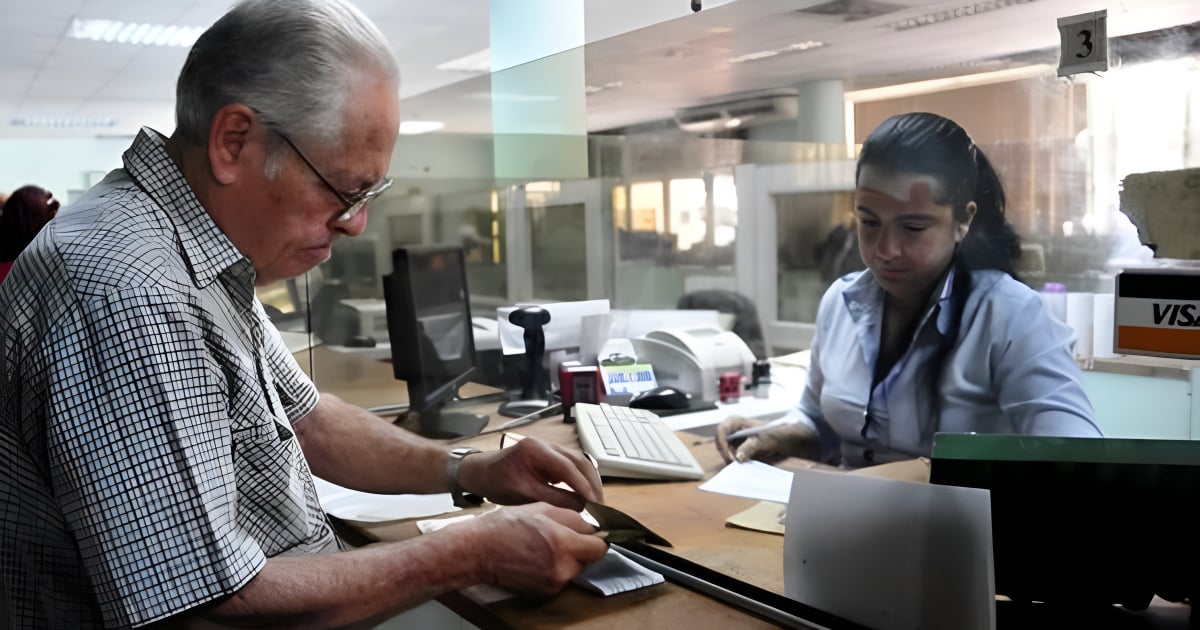

The Cuban regime announced in mid-July a pension increase that will benefit more than 1.3 million retirees starting in September.

The Prime Minister Manuel Marrero Cruz presented the measure as a step in favor of the most vulnerable sectors, but the reality of the currency market turns that relief into an illusion: a month later, the dollar exceeds 400 Cuban pesos (CUP) in the informal market, setting a new record and dragging down the real value of pensions.

On July 15, when the Prime Minister of Miguel Díaz-Canel reported to the National Assembly about the increase in pensions, the greenback was trading around 385 CUP.

Since then, its price has only continued to rise: it ended July at 390, reached 397 at the beginning of August, hit a historic high of 400 CUP on the 12th, and this Tuesday, August 19, it broke that psychological barrier by trading at 402 Cuban pesos. In just one month, the peso depreciated by more than 4%, a pace that crushes any nominal increase.

The reform established that retirees with incomes of up to 2,472 CUP will receive an increase of 1,528, and those who exceed that amount will have their pension adjusted up to 4,000 pesos. In numerical terms, the minimum pension will double, and the maximum will not exceed that limit.

In real terms, the difference is clear: before the increase, a retiree with a minimum pension of 1,528 CUP could barely buy 3.97 dollars in the informal market. After the reform, their pension will rise to 3,056 CUP, which currently amounts to 7.60 dollars.

In other words, the purchasing power in foreign currency nearly doubled (+91%). However, this relief is fragile and is doomed to be short-lived if the devaluation trend continues.

A simple calculation illustrates the paradox: if the dollar continues to rise at the same rate as in the last month (about 18 CUP every 36 days), in about 22 months, the purchasing power of retirees will return to the same level as before the increase.

In other words, in less than two years, the effort announced by the government will be completely wasted.

The chancellor Bruno Rodríguez Parrilla described the measure as an example of the so-called "revolution's" policy of "leaving no one behind." However, the gap between that rhetoric and everyday life is increasingly widening: there are numerous testimonials from elderly people claiming they "cannot eat three times a day," and images of retirees digging through the trash are multiplying.

Economists describe it with popular sayings: it is "bread for today and hunger for tomorrow" or, worse yet, "to plow the sea." The increase in pensions is nullified by the inflationary spiral and the partial dollarization of the economy.

The contrast is even more shocking when considering the revelation that the military conglomerate GAESA has amassed over $18 billion in liquid assets.

While the country's resources are concentrated in the hands of the Castro elite and enormous sums are allocated to luxury hotels with low occupancy, the State barely guarantees pensions that cover even the basics.

In practice, "the inviolable principle of leaving no one behind" has been called into question. The government multiplies its triumphant declarations, but market figures and the daily experiences of millions of Cubans confirm the opposite: retirees are lagging behind, increasingly farther away, trapped in a never-ending devaluation of currency and an economic model that normalizes poverty as part of the national landscape.

Filed under: