Related videos:

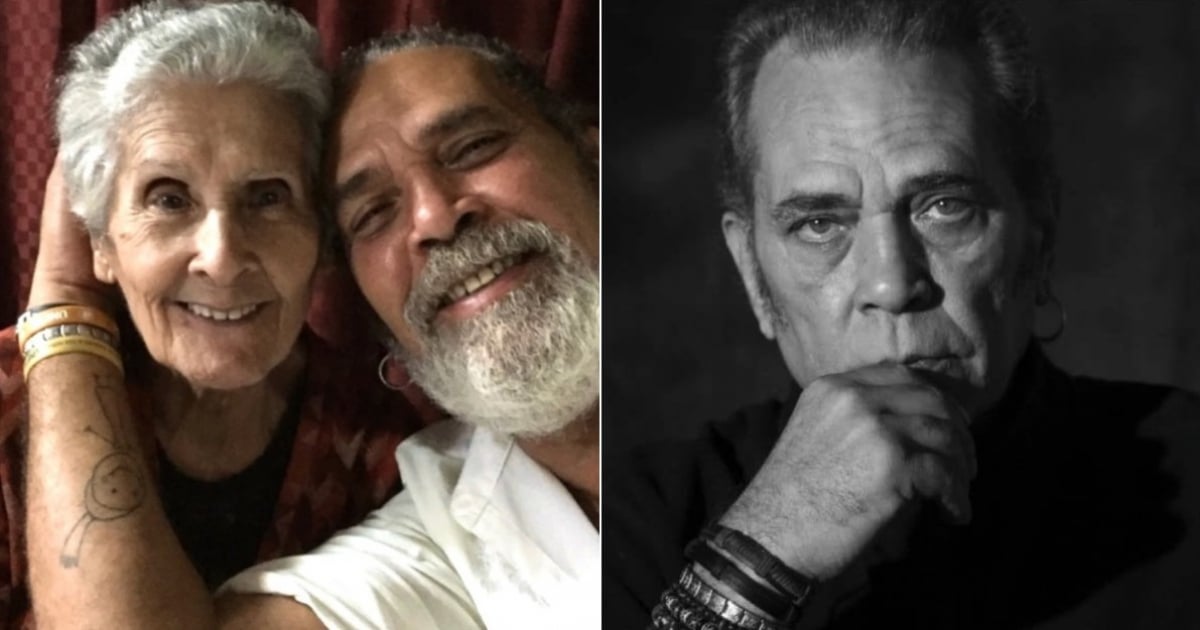

The Cuban actor Luis Alberto García Novoa publicly questioned the recent changes to the currency exchange market in Cuba and raised concerns that, despite the official rhetoric, the new rate does not substantially alter the economic hardships faced by millions of people on the Island.

In a post on Facebook, the performer compared the rates published by the Central Bank of Cuba (BCC) with those reported by the independent media outlet El Toque and concluded that the actual difference is minimal and does not provide any relief for the population.

"Are there truly substantial differences between one and the other? NO. NO. NO. AND NO," wrote the actor, after displaying screenshots of both exchange rates for the same day.

García Novoa recalled the smear campaign launched by the government against El Toque, which was accused of manipulating data and acting with political intentions, while institutions promised "serious, reliable" rates that would be beneficial for the population.

According to the explanation, the contrast between both references demonstrates that the informal market continues to set the real logic of the value of money.

According to El Toque, 100 US dollars are valued at around 4,400 Cuban pesos on the street, while with the new official rate from the BCC, those same 100 dollars—only in digital transactions and not in cash—are exchanged for 4,100 pesos.

The difference, he pointed out, is just 300 Cuban pesos, an amount that practically only covers "three eggs, a pack of Criollo cigarettes, or a small bottle of rum."

"Then EL TOQUE is not wrong in its predictions," he declared.

For the artist, the current gap between the Cuban currency and foreign currencies confirms that the law of supply and demand remains crucial in an economy characterized by scarcity. "If goods are not produced, inflation will continue to be an inflammable inflammation," he said.

Luis Alberto emphasized his complete lack of confidence in the government's economic policies.

"My credibility regarding the measures that have been implemented over the past few years has been in the negatives for quite some time. I don't believe anything from them anymore," he stated.

But he lamented that many Cubans had harbored hopes that the new currency exchange system would alleviate daily expenses.

The most personal and painful example, as she recounted, is that of her mother.

She explained that her monthly pension amounts to 2,178 Cuban pesos. Converted at El Toque's rate, this is equivalent to approximately 4.95 dollars a month; at the new official rate, it amounts to about 5.31 dollars.

In both cases, he emphasized, the amount is not enough to buy a carton of eggs. "It still doesn't reach the cost of a carton of eggs. I won't say more," he concluded.

The backdrop of the protest

The interpreter's statements come after the announcement by the Central Bank of Cuba regarding the entry into effect, on December 18, of a gradual transformation of the exchange market.

The president of the BCC, Juana Lilia Delgado, explained in a televised appearance that the reform aims to correct the coexistence of multiple exchange rates, a phenomenon that, according to the regime, creates distortions, encourages informality, and complicates banking and fiscal control.

The new scheme includes three exchange segments.

A rate of 1 USD to 24 CUP is maintained, reserved for the State for essential imports such as energy, food, medicines, and transportation. Another rate of 1 USD to 120 CUP is established for certain companies with foreign income and exporters.

The main novelty is a "floating" rate, supposedly determined by supply and demand, intended for individuals and non-state management forms.

Although the government presents this structure as a step towards organizing the currency market and strengthening the Cuban peso, various economists have warned that the system consolidates existing inequalities.

The academic Mauricio de Miranda Parrondo questioned the rationale behind maintaining two fixed rates alongside a floating rate and noted that the outcome benefits state imports while penalizing productive sectors that generate real income.

In practice, the daily publication of the "floating" rate by the BCC has not managed to displace the informal market, which continues to set the pace for the value of the dollar in Cuba.

The reason, according to analysts, is structural: the scarcity of foreign currency in the hands of the State and the widespread lack of trust in the Cuban peso.

Due to the restrictions and limited availability in the official market, those who receive remittances or handle foreign currency are opting for the informal market, where prices are higher and transactions are immediate.

It is that disconnection between official announcements and everyday reality that motivated Luis Alberto García's reaction.

His testimony, focused on specific figures and the direct impact on a pension, added a human face to a technical debate that, for many Cubans, translates into a single daily question: how far does the money go for living.

Filed under: