Related videos:

Only three days after its launch, the so-called "floating" exchange system in Cuba has undergone its first adjustments.

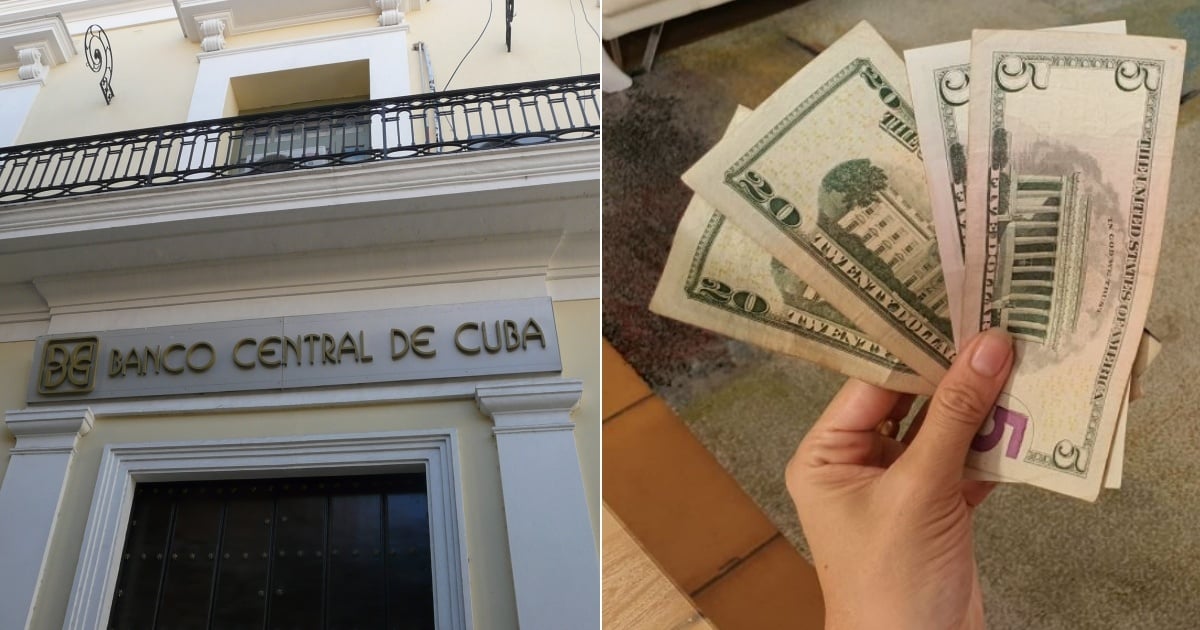

This Saturday, the Central Bank of Cuba (BCC) published a slight reduction in the official values of the dollar and the euro.

The greenback fell from 410 to 408 Cuban pesos; and the European currency decreased from 481.42 to 477.85 CUP.

A variation of two pesos in the case of the US dollar and almost four pesos regarding the European currency.

Meanwhile, in the informal market - where reference prices are actually set for millions of Cubans - the rates remain unchanged: the dollar stays at 440 CUP and the euro at 480 CUP, according to the daily tracking by elTOQUE.

The apparent official "float" still has yet to find its reflection in a market where no one is buying or selling at those prices.

A market that does not exist

The new system was launched on December 18 as part of the Macroeconomic Stabilization Program promoted by the regime. Its structure includes three exchange segments:

Segment I: fixed rate 1x24 CUP for essential state operations.

Segment II: intermediate rate of 1x120 CUP for companies with external income.

Segment III: daily floating rate, supposedly based on supply and demand, intended for individuals and small and medium enterprises.

According to the BCC, the goal of the mechanism is to move towards a future currency unification without causing a monetary collapse.

The president of the bank, Juana Lilia Delgado, asserted in her presentation that this scheme would reflect "the real conditions of the Cuban economy." However, the facts on the ground seem to tell a different story.

In practice, the supply of foreign currency remains minimal or nonexistent, restricted to remittances and exports channeled through legal means.

Through CADECA, citizens can only access up to 100 USD per digital transaction, provided there is availability, which is rarely the case. The promised "float" resembles more of a mirage than a real market dynamic.

Without trust, without liquidity, without impact

The government announcement was presented as a step towards transparency and the reduction of the black market.

However, since its implementation, what has become clear is that the mechanism operates without genuine free supply and demand, and above all, without public trust.

"Floating without water," some economists have called the experiment.

On official networks and platforms like Cubadebate, internet users have reacted with sarcasm and disbelief.

“Criticizing elTOQUE only to end up the same way,” wrote a commentator, summarizing a general sentiment that points to the regime's current dependence on the same type of rate it criticized for years.

The slight decrease in official rates this Saturday only confirms the decorative nature of the new system: without a real foreign exchange market or genuine adjustment mechanisms, any changes lack substance.

It is a "floating" object that floats, but in the air.

The informal market, immune to the floating rate

Meanwhile, the informal currency market continues to set the economic tone of the country.

On December 20th, the dollar and the euro showed no changes compared to previous days, while the freely convertible currency (MLC) - the regime's digital instrument - decreased from 315 to 310 CUP.

It is a slight decline that some attribute to the expectations created by the implementation of the new official rate, although without significant structural impact.

For the third consecutive day, the two main indicators - the dollar and the euro - remain stable in the informal market, completely ignoring the movements of the BCC.

This reaffirms what many analysts have been warning: the street remains the true thermometer of the Cuban economy, not the government's resolutions.

A validation of the black market

The creation of a floating exchange rate for individuals and small and medium-sized enterprises is, at its core, an implicit admission of defeat: the state model has failed to establish an economy with clear rules, transparency, or trust.

The new system allows, for example, self-employed workers and small business owners to access foreign currency from tax accounts, up to 50% of their quarterly gross income.

In theory, this aims to limit their reliance on the black market. However, in practice, most continue to turn to it due to the limited official availability of foreign currency.

In this context, the floating rate does not seem like a genuine reform, but rather a resignation disguised as monetary policy. It is an attempt to mask an informal economy that is already structural and, at times, more efficient than the formal one.

A country that drifts... aimlessly

The adoption of a daily floating rate by the Central Bank does not address the underlying issues: inflation, monetary duality, fiscal deficit, declining production, product shortages, and, above all, massive distrust in the state financial system.

With an average state salary equivalent to just 16 dollars a month at the official rate, most Cubans continue to rely on the informal market not only to access foreign currency but also to purchase food, medicine, and basic goods.

The floating of the Cuban peso —at least on paper— still fails to anchor the country on any secure shore. Instead, it reinforces the feeling of drifting, of a worn-out model, and of public policies that merely simulate control without making any substantial changes.

As a critical economist based in Havana stated, “without liquidity or a real supply of foreign currency, this floating rate is like a raft in a dry puddle.”

Filed under: